Brink's Direct Credit Overview

Why wait for your deposits before using it for working capital?

Use your cash within one business day and rely less on interest‑based loans or lines of credit to manage your cash flow.

Access a new stream of working capital by getting credit for cash deposits within one business day.

Use your cash within one business day and rely less on interest‑based loans or lines of credit to manage your cash flow.

Guarantees deposits in your bank next business day for seamless integration of your cash operations.

Eliminate trips to the bank for daily bank deposits by getting faster access to your funds digitally.

Eliminate in‑branch deposit fees and reduce your costs by having Brink's electronically credit your accounts instead.

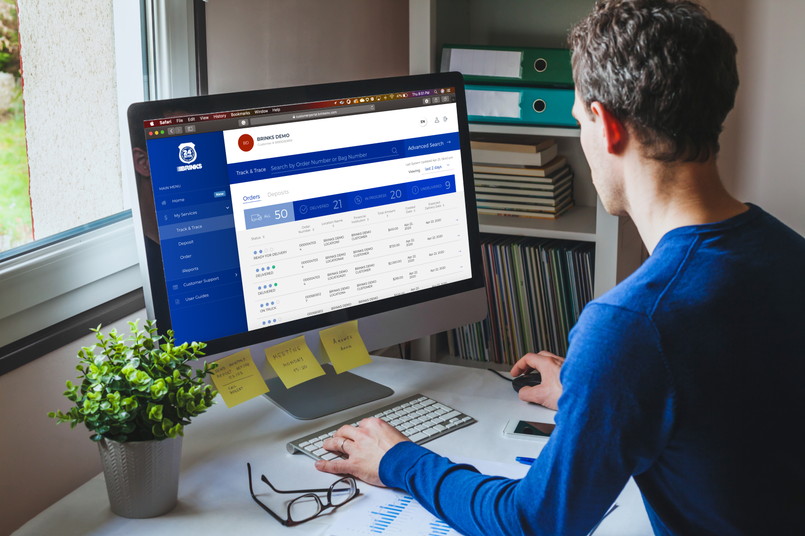

Improve cash management with the Brink's 24SEVEN app. You can make deposits at your business, change pick-up days at Brink's Complete devices, track deposits, and track your funds posting within 24 hours of depositing at any Brink's device Fill in.

With cash continuing to be a preferred payment method for consumers of all ages, cash-handling technology is constantly evolving for the future. As a result, both retailers and banks are always looking to invest in new services and devices to meet the needs of their customers more efficiently.

Despite the growing popularity of mobile payments, cash is still being heavily used by consumers across the country. With this, many people are still using cash to pay for government fees such as taxes, parking tickets, court fees, and more. This use of cash creates a need to effectively manage cash intake for efficient daily operations in government facilities.